One of the surprising "tech" product launches last year was the Apple Card. The company pitched it as a way to help Apple customers make smarter financial decisions through the help of a more intuitive app. The Apple Card has some interesting ideas, but it's basically just a cash-back credit card. A new report and leaked images reveal that Google is developing a similar product tentatively called "Google Card."

The report comes out of TechCrunch and they refer to the Google Card as a "smart debit card." Many of the concepts are similar to the Apple Card, but the Google Card is a debit card. It's a physical card that also exists as a virtual card in Google Pay, just like any other card you've added. The big difference between the Google Card and some other credit/debit card will be the integrated and detailed financial tracking.

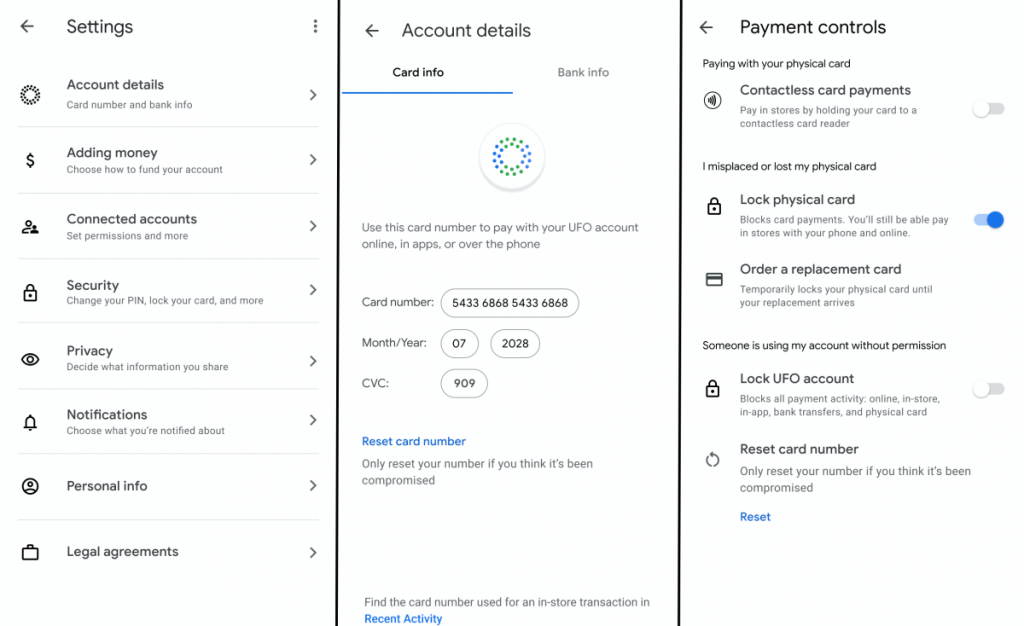

Like any debit card, the Google Card will be tied to a checking account. Users will be able to access this account to check their balance, track purchases, add money, lock it, and other features in a new Google app. The card will be co-branded with bank partners such as CITI and Stanford Federal Credit Union. Leaked images give us a look at some of the other details.

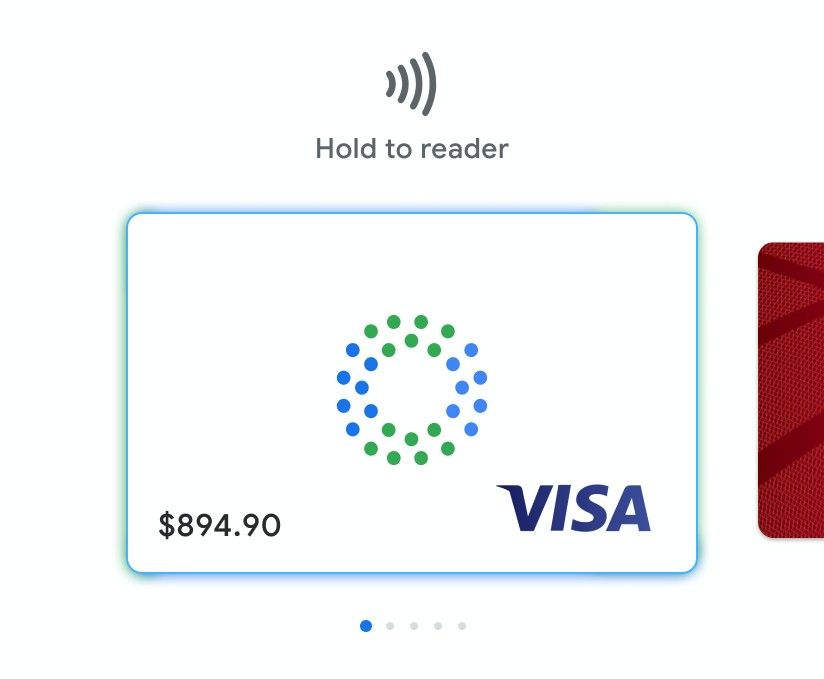

The physical card itself is white with the logo of the partnered bank and Google. We can see that it's a chip card on the Visa network, but there could be other networks included. The card design (which may not be final) also features a strange blue and green dot pattern. More important than the plastic, however, is the app experience, which is what should really set the Google Card apart from other debit cards.

The app will show recent transactions with merchant and date details. Since this is Google, there will be a wealth of information available as well. You will be able to see the location of the purchase on a map. If a card is lost or foul play is suspected, the user can lock the card immediately from the app and order a replacement. The virtual card will remain active as it has a different number than the physical card, so you won't be completely out of luck. If the virtual card is the card in question, the user can rest it quickly.

In the app settings, we can see notification options and privacy controls. Users will be able to decide what information they want to share. Privacy is obviously going to be a big topic around the Google Card. People don't have the same amount of trust for Google as they do for Apple. Many of us already give Google a lot of our personal information, but handing over the reigns on personal finance may be a bridge too far.

Some of this may sound familiar if you remember Google Wallet, which also had a physical component, but was ultimately replaced by Google Pay. Tech companies like Google and Apple are better suited for making software that's easy to use and understand. That's the appeal of signing up for an Apple Card or Google Card. TechCrunch did not give a timeline for when to expect the Google Card to become a reality. Are you interested in this product?

Source: TechCrunch