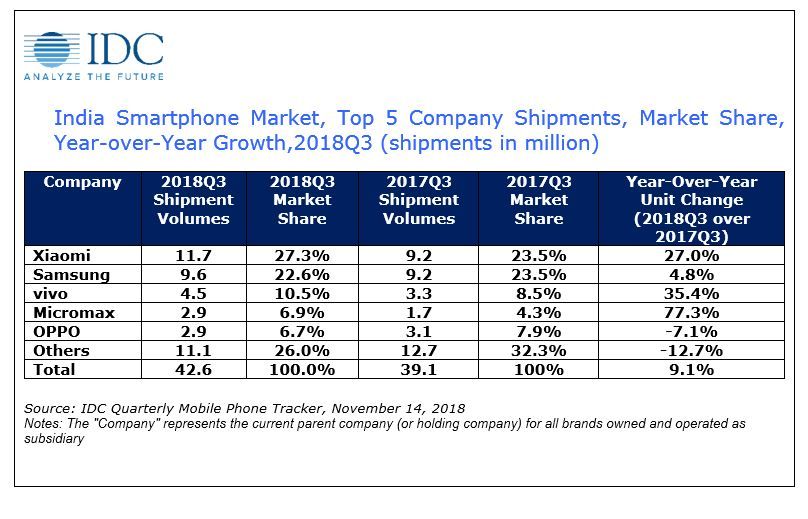

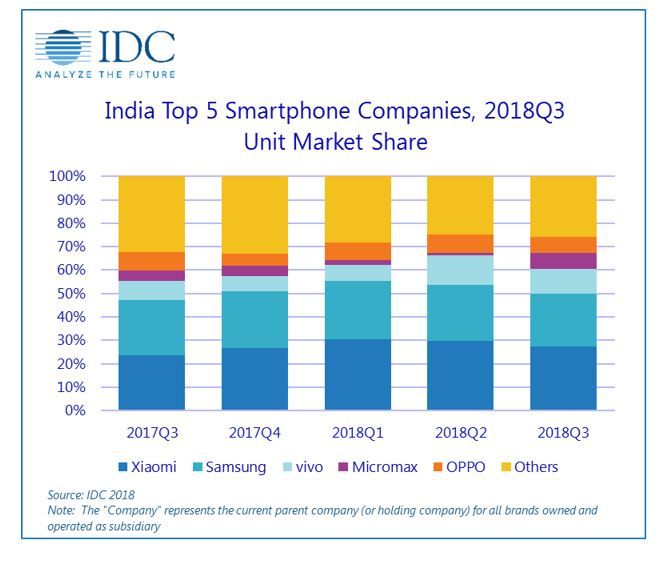

IDC has released its report for the Indian smartphone market in Q3 2018. According to the company's Quarterly Mobile Phone Tracker, the Indian smartphone market reached an all-time high of 42.6 million-unit shipments in 3Q18, growing 9.1% year-over-year. IDC states that this is the first time when the smartphone market is at par with the feature phone market, with each market contributing 50% to the overall mobile phone market (previously, feature phone shipments were higher than smartphone shipments in India).

IDC notes that shipments in 3Q18 were primarily driven by the e-tailer channel in preparation for festive sales. E-tailers drove affordability by giving cashback on debit/credit cards and no cost EMI. Strong online-only device portfolios by brands like Xiaomi, Honor, Realme, Asus, Honor, and more, resulted in 37% quarter-on-quarter growth. The online share, therefore, now has 39% share of the smartphone market.

Realme and Asus entered the top five online brands list for the first time with the Realme 2/2 Pro and the Asus ZenFone Max Pro M1. In the $400+ price segment, OnePlus achieved its highest ever shipments in a single quarter, and it managed to push online smartphone ASP (Average Selling Price) to $166 in 3Q18 from $156 in 3Q17.

Xiaomi shipped 11.7 million units in 3Q18 thanks to record sales of the Xiaomi Redmi 5A and the Xiaomi Redmi Note 5 Pro. The company's refreshed Redmi 6/Redmi 6A series also made a mark. IDC notes that "Xiaomi [...] made an aggressive entry in the mid-premium segment" of $300-$500 with the Xiaomi POCO F1. (It can observed that it shook up the foundations of the affordable flagship segment.)

On the other hand, the offline segment grew by 6.6% in 3Q18---a slower growth rate. According to IDC, some of this can be attributed to the impact of e-tailer aggression, and exclusive online-only phones. However, the offline channel still dominates as it has 60% share of the Indian smartphone market.

Meanwhile, OnePlus surpassed Samsung and Apple in 3Q18 in the premium end of the market ($500+), thanks to strong sales of the OnePlus 6. OnePlus has been gradually scaling up its volumes, according to IDC. On the other hand, the Apple iPhone XS and iPhone XS Max were said to be "unable to create much demand [...] due to [their] high pricing in the India market."

IDC also included a brief note about the feature market, which grew by 2.1% year-over-year to ship 43.1 million units in 3Q18. Interestingly, JioPhone shipments continued to decline as the vendor is said to be focused on clearing existing channel inventory. The 2G/2.5G feature phone market grew by 19.6% quarter-over-quarter after declining for the past two quarters. IDC states that this was because of higher shipments of vendors such as Samsung, HMD Global, and Lava, who led the segment.

Xiaomi took first position in the Indian smartphone market, growing by an astonishing 27.0% year-over-year in 3Q18. The Redmi 5A and the Redmi Note 5 Pro are still the fastest selling smartphones in India with a combined shipment of more than five million in two consecutive quarters, according to IDC. Xiaomi also maintained its lead in online channels with a 48.9% share, while simultaneously growing its offline retail shipments.

Samsung remained in second position, and continued to lose share from the past few quarters. IDC states this is owed to the "rapid growth" of China-based companies like Xiaomi, Vivo, and OPPO. Samsung's annual growth was 4.8% this quarter thanks to phones like the Samsung Galaxy J6, Samsung Galaxy J2 2018, Galaxy J8, Galaxy J4, and the Android Go-powered Galaxy J2 Core. (It should be noted that all of these phones have a poor value proposition.)

Vivo remained in third position with a year-over-year growth of 35.4% this quarter. The Vivo Y81 and the Vivo Y83 Pro are said to have picked up "significant demand" along with the top-selling Vivo Y71 and the Vivo V11/V11 Pro. Vivo was able to maintain high shipments thanks to "huge investments" in marketing and promotional activities as well as attractive channel partner schemes, according to IDC.

Surprisingly, Micromax climbed up to fourth position and entered the top five vendor list after declining for seven consecutive quarters. Figures can be deceiving, however, as the reason for Micromax's rise is not an increase in end-user sales, but something else. In partnership with Reliance Jio, Micromax had won a state government tender with the Chhattisgarh government to supply smartphones to underprivileged students and women. Therefore, Micromax's shipments will certainly decline after this quarter as this was a one-off event.

The situation was more worrying for OPPO. The company dropped to fifth position as its shipments declined by 7.1% annually this quarter. IDC's attributions for this were fewer promotional activities and non-availability of attractive channel and consumer schemes. The OPPO F9/F9 Pro were unable to create much demand, but OPPO returned to the flagship segment with the launch of the OPPO Find X.

For the next quarter, IDC expects smartphone vendors to raise prices of phones thanks to duty hikes and the fluctuation in the value of the Indian rupee with respect to the US dollar. This is already happening as vendors like Xiaomi and Realme have increased the prices of some of their phones.