In the first quarter of 2019, we experienced some of the most polarizing trends in the smartphone market, including optical zoom, ultrasonic fingerprint scanners, as many as five rear cameras, different means to accommodate the selfie camera etc. But even this extensive innovation could not prevent the global market from plunging for the sixth consecutive quarter. Samsung maintained its dominance but its share in the market plummeted marginally while Apple lost the second position to Huawei, which displayed a monumental growth compared to last year.

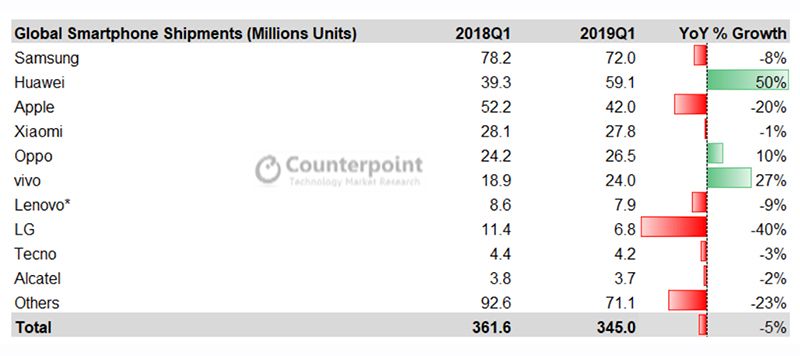

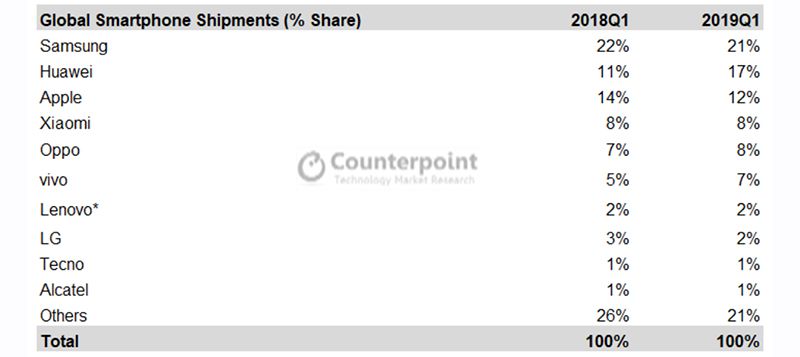

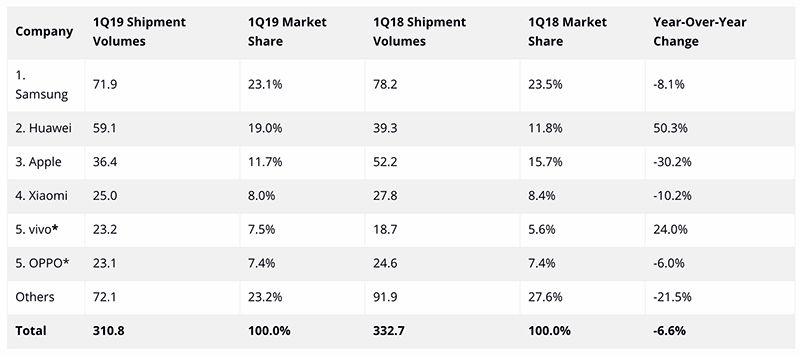

Two independent reports from market research firms Counterpoint Research and IDC validated each other's findings of Huawei's impressive growth in the first quarter of 2019. As per both the reports, Huawei's global smartphone grew by 50% in spite of its unavailability in the U.S. and this helped it knock Apple down from the second position worldwide. In terms of the market share, Huawei's presence grew from occupying 11% of the market in Q1 of 2018 to 17% in the past quarter. This iterates Huawei's massive success in Europe and is because of the "positive momentum" of its wholesome portfolio across all price brackets, as per IDC. Because of this growth, Huawei may continue to maintain the second spot throughout this calendar year.

Samsung, according to Counterpoint, shipped 6 million fewer units in Q1 of 2019 compared to the last year. This is in spite of greater sales of the Galaxy S10 series compared to the last year's S9 duo. The Korean giant reported in its earnings call that it made a decent profit but there was a decline in the overall revenue due to stiff competition in the entry-level and mid-range. It's market share, however, declined by only 1%.

Apple, on the other hand, sold 20% fewer iPhones during the last quarter compared to a year earlier. While Counterpoint's reported trend for iPhone sales matched IDC's, the latter reported a 30% decrease in the overall shipment of iPhones. This decline was primarily due to the longer upgrade cycles for iPhone users. Apple's market share reduced from 14% to 12% according to Counterpoint, and from ~16% to ~12% as per IDC.

Both the reports agree that Vivo was another brand that registered sizeable growth of around 25% compared to the last year. For OPPO, however, there were contradictory discoveries with Counterpoint claiming that the Chinese brand grew 10% while IDC reporting a decline of 6%.

Lastly, echoing previous findings by Counterpoint, IDC noted that India was the only market to grow despite the global slowdown. In India, Xiaomi continued to lead the market, especially because of its push into non-urban regions of the country.