Qualcomm has been the dominant player in the smartphone SoC vendor market for much of the last decade. MediaTek has long performed the role of providing cheaper SoCs in the smartphone market. Samsung and Huawei's HiSilicon, on the other hand, make custom SoCs that are intended for use in their own smartphones. Samsung System LSI's Exynos SoCs were used only by Samsung Mobile's phones, for example, while HiSilicon's Kirin chips are used in Huawei and Honor phones. In 2019, this equation changed as Samsung System LSI started selling Exynos chips to other vendors such as Motorola and Vivo. This has helped the company achieve the position of being the third largest smartphone application processor (AP) vendor globally in 2019, according to a report by Counterpoint Research.

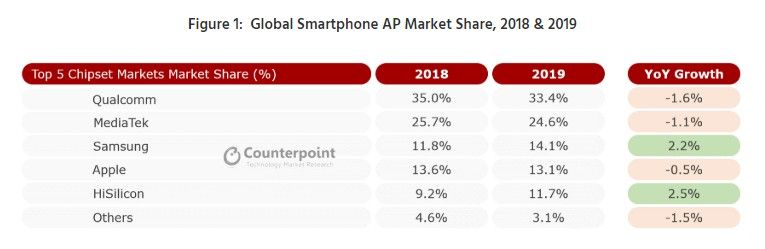

Counterpoint Research has released its latest quarterly handset report. According to the report, Samsung Electronics and HiSilicon were the only vendors among the top smartphone SoC vendors to see positive share growth in 2019, while Qualcomm, MediaTek, and Apple all saw declines.

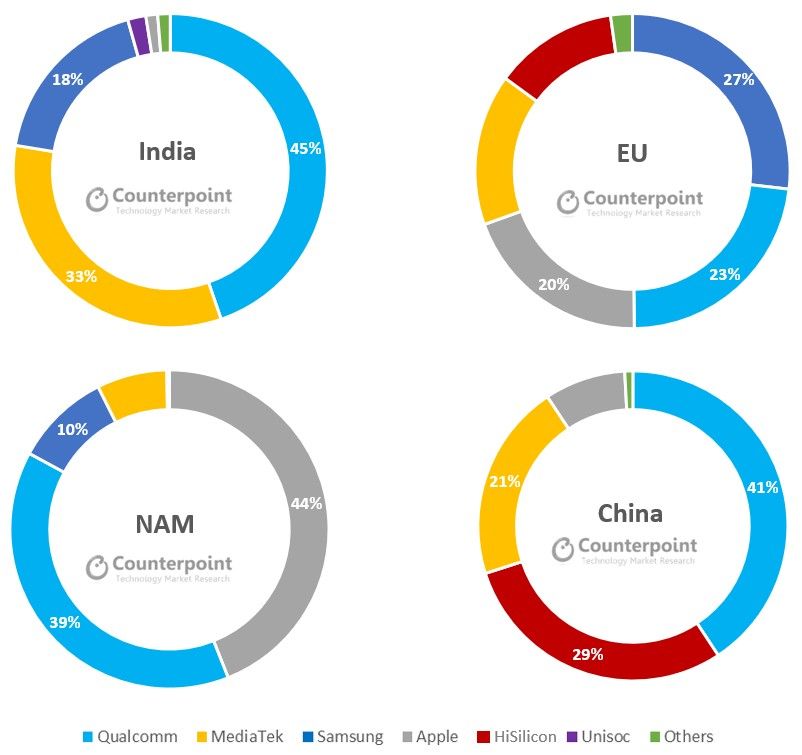

Qualcomm remained the top vendor of application processors, despite suffering a 1.6% decline through the year. It still accounts for one-third of smartphone AP shipments in 2019. Its shares exceeded 30% in all markets except Middle East & Africa (MEA), where lower demand for high-end phones tempered demand for Qualcomm chips in comparison to other markets. This is because Qualcomm's chips are traditionally more expensive than MediaTek's chips, for instance.

MediaTek also saw a slight decline in its market share in 2019, while maintaining its second-place position. It had strong performance in markets like MEA, India, and Southeast Asia, with the demand being driven by low-to-mid-end phones. The company achieved one-quarter market share of global smartphone AP sales.

Huawei (HiSilicon), on the other hand, saw its market share decline in many markets outside China due to the US trade ban. Ironically, the company was able to offset these issues by "significantly expanding presence and share" in its domestic market of China.

Samsung performed particularly well in Europe, India, and Latin America, and its market share increased in other regions such as North America as well. Counterpoint Research notes that competition between these AP vendors intensified in 2019, as the focus was getting the balance right between processing speeds and price. Samsung's share increased by 2.2% year-over-year in a declining market. However, the company outsourced some of its A-series smartphone manufacturing to Chinese ODMs since the last year, and Counterpoint says this will drive some share gains for Qualcomm and MediaTek. Also, the rising proliferation of 5G phones in the US and China will increase Samsung's dependence on Qualcomm chips in its flagship and high-tier phones in these regions. (Currently, the company relies on Snapdragon chips for the North American/Chinese/Japanese/South Korean/Latin American variants of the Galaxy S20 series, which are sold only in a 5G configuration. The Exynos 990 global variants are further bifurcated into 5G and 4G variants.)

Counterpoint further noted that Samsung is horizontally scaling with an aim to sell its 5G SoCs to Chinese brands this year, in order to help drive Exynos chip volumes in 2020. (The Vivo X30 and X30 Pro feature the company's upper-tier Exynos 980 SoC, for example.) Samsung is also increasingly adopting its Exynos chips across its own portfolio designed and manufactured in-house for global regions except for the US/Japan/China. Therefore, the company estimates Samsung's overall share of the smartphone application processor market to grow further in 2020.

5G will be an important part of the story as well. 5G integrated chips with support for sub-6GHz networks will start to factor in as a competitive advantage, according to Counterpoint. Examples of such chips include the Qualcomm Snapdragon 765, MediaTek Dimensity 1000/L, and the MediaTek Dimensity 800. These chips reduce power consumption by reducing the need for an external 5G modem, and they also take up less space within the phone. Counterpoint estimates the cheapest 5G phone to be powered by an integrated 5G chip to go to sub-$300 prices in the second half of 2020, as vendors from HiSilicon, Qualcomm, MediaTek, Samsung, and even Unisoc are all pushing. In the premium segment, however, discrete 5G modem solutions will continue to be seen in the upcoming 5G iPhones as well as the Qualcomm Snapdragon 865 + X55 modem-powered flagship Android phones.

Source: Counterpoint Research