Even though Samsung saw a significant decline in sales in Q1 2019, the company seems to have picked up the pace with its Galaxy A series in Q3 2019. According to the latest report from Counterpoint Research, three smartphones from the company's Galaxy A series have made it to the top-selling list in the third quarter of this year.

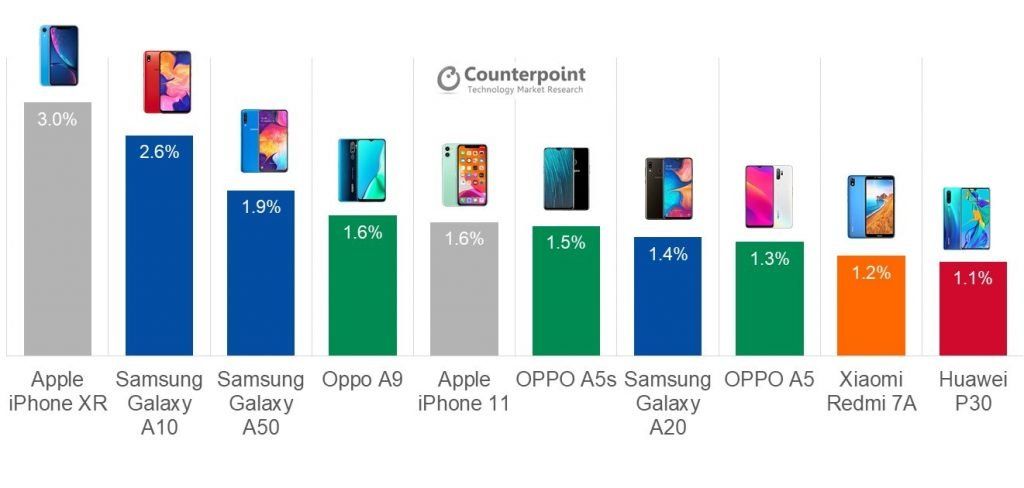

The Market Pulse report reveals that the Samsung Galaxy A10 captured a total sales market share of 2.6%, taking the second spot right behind the Apple iPhone XR at 3%. The Samsung Galaxy A50 took the third spot at a sales market share of 1.9%, while the Galaxy A20 took the seventh position with a total sales market share of 1.4%. The increase in sales could be attributed to the company's move to discontinue the Galaxy J series and bring the A series to lower price tiers. Since the Galaxy A series has had a more premium perception than the J series, it seems to have boosted sales for the company.

But it wasn't just the public perception of the devices that boosted sales. Unlike older devices, Samsung offered great specifications and design features in the Galaxy A series at an affordable price point, which also played a major role in the boost in sales. However, Samsung failed to gain similar sales figures for its flagships and none of them feature in the top 10 list released by Counterpoint Research.

Along with Samsung, Chinese smartphone OEM OPPO managed to secure three spots in the top 10 list with its A series. The OPPO A9, A5s and A5 took the fourth, sixth, and eighth spot, achieving sales market shares of 1.6%, 1.5%, and 1.3%, respectively. Despite recent setbacks, Huawei also managed to secure a spot in the top 10 with the Huawei P30. The device took the tenth spot with a total sales market share of 1.1%. Xiaomi also featured in the list at the ninth spot with the Xiaomi Redmi 7A with a market share of 1.2%, while the fifth spot was taken by the recently launched Apple iPhone 11 (1.6%).

The report further reveals that the volume contribution in total sell-through for the top 10 devices increased by 9% YoY to capture a total of 17% of sales compared to 15% in Q3 2018. However, the combined wholesale revenue of the top 10 models declined by 30% YoY as more mid-range and budget devices made an appearance on the list. This increased adoption of budget and mid-tier products has led to setbacks in revenue for key smartphone manufacturers during the quarter with the overall global handset profits declining 11% YoY in the quarter. For more details from the report, you can follow the source link below.

Source: Counterpoint Research