The National Payments Corporation of India (NPCI) has given WhatsApp the green light to expand its UPI-based payments service to more users in the country. WhatsApp Pay initially received regulatory approval to run a pilot program with up to 10 million users earlier in February this year. At the time, sources familiar with the matter had revealed that if WhatsApp was able to fulfill all compliance requirements, it would be given permission for a full rollout. It seems like WhatsApp has finally managed to meet all requirements, as the NPCI has now permitted the Facebook-owned messenger to go live on the UPI framework in a staged fashion.

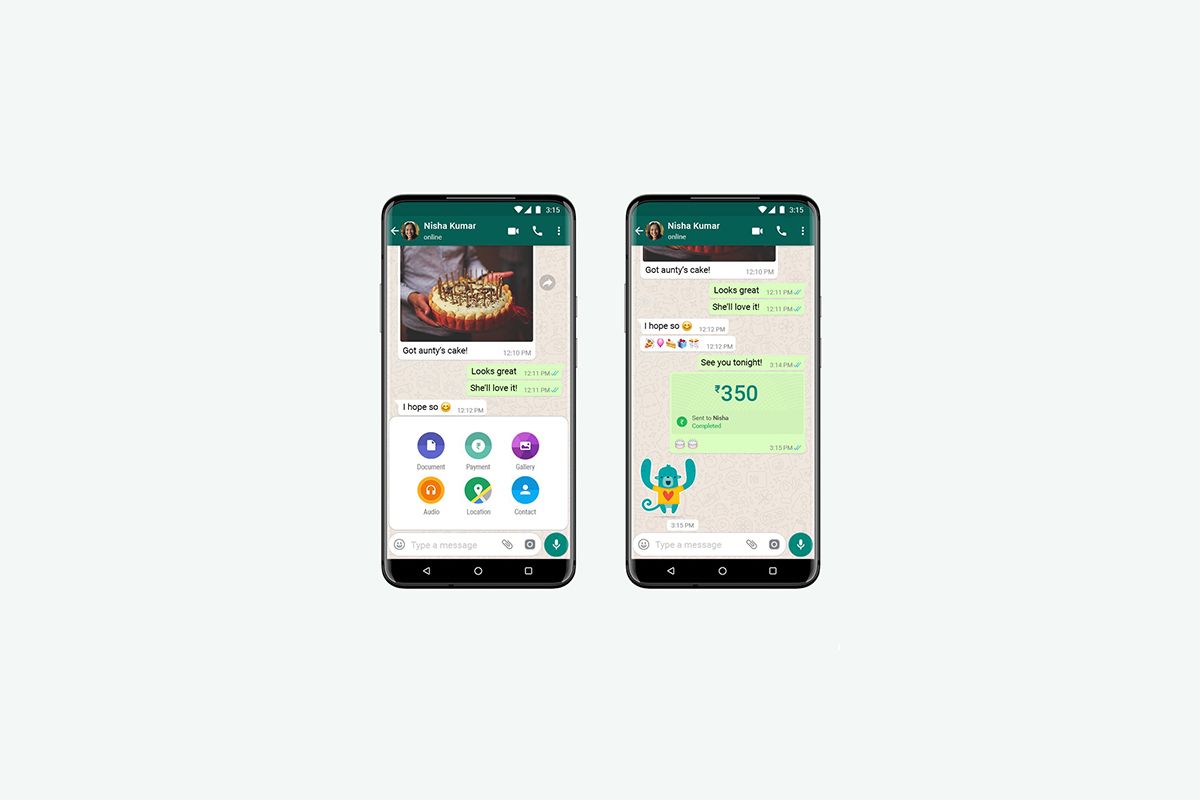

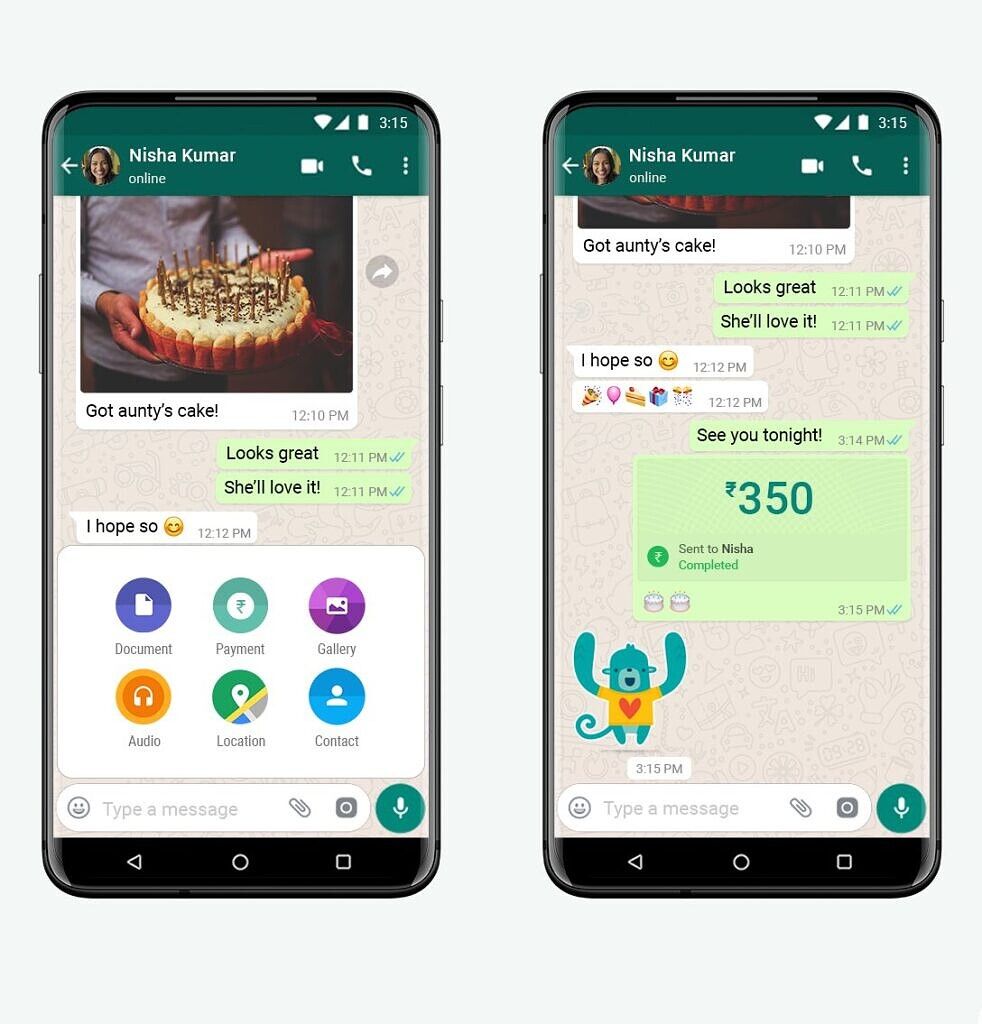

In the first phase of rollout, WhatsApp Pay can expand its service to just 20 million of its 400 million users in India. In case you're one of the lucky few who get access in the first phase, you'll be able to set up a payment method on the messenger by tapping on the three-dot menu icon in the top right corner and then selecting the new Payments option. After you verify your phone number and bank account, you should see the payment method listed on the payments page.

Once your payment method is set up, you'll be able to send and receive money via WhatsApp Pay by selecting the new Payment option in the attachments menu. Currently, WhatsApp Pay supports transactions with over 160 banks in the country. To facilitate the service, WhatsApp has partnered with five leading banks in the country — ICICI Bank, HDFC Bank, Axis Bank, The State Bank of India, and Jio Payments Bank. The service is available in 10 regional language versions of WhatsApp, and it just requires users to have a valid debit card with a bank that supports UPI payments.

WhatsApp Pay poses a major threat to other UPI-based payments services in the country, like Google Pay and PayTM, due to its large user base. However, the NPCI has introduced a new regulation to ensure that WhatsApp cannot abuse its position in the Indian market to get an edge over the competition. As per a recent report from Bloomberg Quint on the matter, the new regulation will place a market share cap of 30% on the volume of UPI transactions starting from January 2021.

The 30% cap will be calculated based on the total volume of transactions processed in UPI during the preceding three months on a rolling basis. The market cap will go into effect starting next year, and any third-party app which exceeds the cap as of January 1, 2021, will have to meet it within two years in a phased manner. Sources familiar with the matter have revealed that Google Pay and Flipkart's PhonePe currently control about 80% of the country's UPI transactions market.